Hey friends, money-smart friend! This is Faizan Ali speaking. Honestly, managing my personal finances for many years felt like keeping cats together – stressful, messy, and honestly a bit overwhelming. The budget was being made, but then it broke. Expenses never came within my count, and financial goals just seemed like distant dreams. You also feel this way, don’t you?

So listen, I’m going to tell you something that completely flipped my financial life. This is a super smart workflow with which you can manage all your personal finances through Google Sheets. Seriously, forget about expensive software and complicated apps – this is free, simple, and surprisingly powerful. Spend a little time setting it up, and then – it will feel like you’re holding the steering wheel of your money. And this is not just about calculating numbers, understood? This is a way to build a rock-solid base that brings real and lasting financial peace.

So then, what do you say? Are you really ready to ditch your money worries and get a totally clear picture of your finances? Amazing! So let’s jump right in and see what Google Sheets can do for you. Seriously, this is not a temporary gimmick; it is a game changer – a big step forward in our personal finance journey, together.

Why Google Sheets for Personal Finance?

When I first heard that spreadsheets can be used to manage money, my initial reaction was, “Ugh, another boring task.” 😅 But as soon as I started using them, it was like a lightbulb got turned on! Now, Google Sheets has become my favorite financial budgeting tool for several reasons:

Free and Accessible

To be honest, that’s the biggest deal for me. All you need is a Google account, and you get access to it for free. No subscriptions, no hidden charges. Whether you use a laptop, tablet, or phone – if you have internet, you can access your financial sheet from anywhere.

For me, this was a game-changer, as I was able to update my expense tracker on-the-go. It made consistency incredibly easy.

Flexible and Customizable

Google Sheets is nothing like rigid apps. It easily adapts to your life. Got different income streams? Not a problem. Need to track unique categories like “gaming setup upgrades” or “travel fund”? Simple. There is no need for you to fit into someone else’s system.

In my case, I am able to easily track my freelance income and random spending habits.

Powerful Tracking and Analysis

This is where the real magic begins. With simple formulas, you can automate your calculations, track your spending trends, and visually see where your money is going through charts. Numbers are easily converted into insights.

For me, seeing my expenditure categories in a chart was an eye-opener – it became easy to understand where I could make cuts without sacrificing my comfort.

Building Your Google Sheets Personal Finance Dashboard

Think of Google Sheets as your financial command center. Here you can keep your entire money system organized. Let’s start with 3 important sheets that will get you on track.

Sheet 1: “Income & Budget” Hub

This is essentially your master plan – a financial blueprint. In this, you will write all your income sources and set the budget for the month.

- Income Sources: Write everything like salary, freelance earnings, side hustle income, etc.

- Budgeted Expenses: Break down your expenses into categories.

- Fixed Expenses: Those that are almost the same every month, such as rent/mortgage, loan payments, subscriptions, insurance.

- Variable Expenses: Those that vary each time, such as groceries, eating out, entertainment, shopping, transport.

- Difference / Savings Goal: A simple formula (Total Income – Total Budgeted Expenses) will let you know how much is left for savings or debt repayment.

When I first started, my “budgeted expenses” were just estimations. It took a few months to understand a realistic picture. Don’t worry if the first budget is not perfect – it’s a living document, it will get better over time.

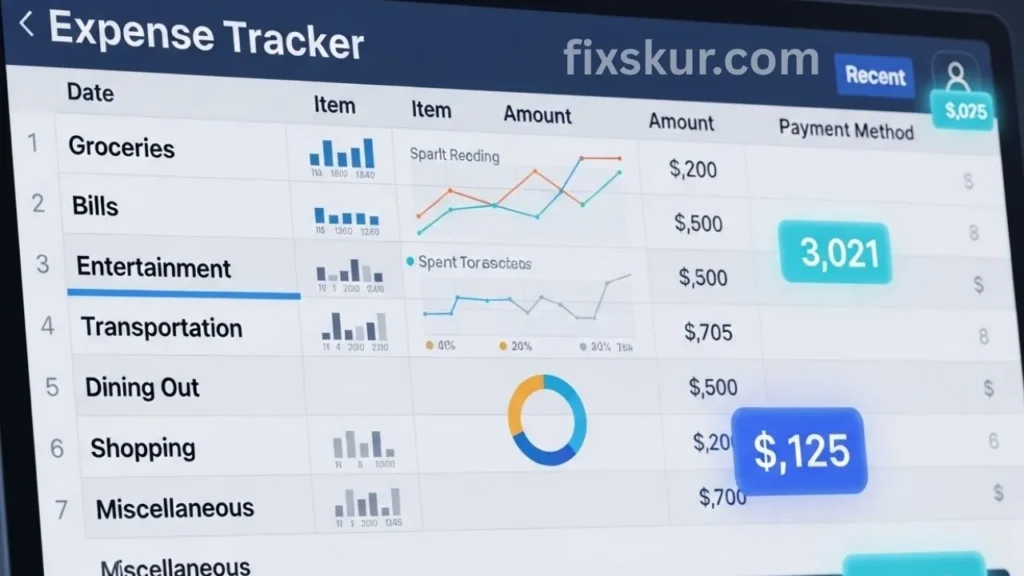

Sheet 2: “Expense Tracker” – The Daily Grind

This is where the real work happens. Initially, it may seem boring, but trust me, it gets comfortable. All you have to do is record each of your expenses. This consistency will show you your real spending habits.

Columns that I use:

- Date: (Like 8/27/2025)

- Category: (Groceries, Utilities, Coffee, Entertainment, etc.) Pro-tip: Use Data Validation to create a drop-down to make entry quick and typo-free.

- Item/Description: (Weekly shop, Electricity bill, Latte, Cinema ticket)

- Amount: (Like 45.75)

- Payment Method: (Credit Card, Debit Card, Cash)

- Notes (Optional): If you want to add any special detail.

Initially, this sheet felt like a task. Remembering everything at the end of the day was a task. I used to insist, and sometimes even at the end of the week – which never used to work! Whatever work came up became a habit: now I immediately write the expense on the phone whenever I do it. It takes 10 seconds, and the data stays accurate.

Sheet 3: “Savings & Debt” Monitor

This sheet shows you the progress of your financial goals. Whether you are saving for a down payment, want a new camera, or are aggressively repaying your student loan – watching the numbers changing is very motivating.

- Savings Goals: What are you dreaming of? Whether it is an emergency fund, a new laptop, or finally booking that amazing vacation – just list all your goals. Then start watching your progress as you get closer to achieving them!

- Debt Repayment: For every debt that you are paying (be it Student Loan A, or that stubborn Credit Card B, you know what I mean!), write down the original amount, how much is owed now, and if you are making extra payments, note that too. Seeing the numbers gradually decrease is quite motivating!

Look, I can completely understand – repaying debt can sometimes feel like climbing Mount Everest. Believe me, I’ve felt that way too, completely overwhelmed. But when you see the balance gradually decreasing on the spreadsheet, it’s just suddenly motivating. It’s a real and tangible reminder that your hard work is actually paying off. Every single penny, every single dollar you put in, truly makes a difference, I promise!

Automating Your Google Sheets Workflow

Now, you have your core sheets ready, let’s make them smarter! This is where Google Sheets shows its true magic – just like a personal financial dashboard.

The Magic of Formulas: SUMIFS, AVERAGE, SPARKLINE

Don’t worry, there is no need to be scared by the word “formulas”. They are your friends – they save time and provide insights instantly.

- SUMIFS for Category Spending: Well, this is actually a lifesaver! In your ‘Income & Budget’ sheet, you can easily use SUMIFS to derive the actual spending of each category from the ‘Expense Tracker’. For example: =SUMIFS(‘Expense Tracker’!D:D, ‘Expense Tracker’!B:B, A5). It’s simple – basically, all the numbers in column D of the ‘Expense Tracker’ are added when the category in column B matches with A5 in your sheet. Easy, fast, and useful! Simple! Now you can immediately see if you are over or under budget in each category.

- AVERAGE for Trends: Want to know your average monthly grocery spend? Just use =AVERAGE() on your grocery expenses.

- SPARKLINE for Quick Visual Trends: These are mini-charts that fit within a single cell. For example, =SPARKLINE(B2:B10) will show you how your utility bill has changed over the past few months.

Creating Simple Visualizations (Charts & Graphs)

Numbers are good, but visuals tell the story more clearly. It is very easy to create charts in Google Sheets.

- Pie Chart for Spending Categories: Select your categories and their actual spending, insert a pie chart – and you will immediately know where most of the money is going. It can sometimes be shocking!

- Line Graph for Income/Expense Over Time: Track total income and total expenses for each month, and create a line graph. You will clearly see whether expenses are increasing or income is growing.

You don’t need to be a data scientist. Google Sheets’ suggested charts are quite useful. Experiment a little, and your financial data will start to seem easy and less scary.

Smart Tool: Google Forms for Easy Expense Entry

Remember I told you it’s best to log expenses immediately? Google Forms makes it even easier.

- Create a new Google Form.

- Add questions:

- Date (Date field)

- Category (Dropdown with expense categories)

- Amount (Short answer with number validation)

- Description/Item (Short answer)

- Payment Method (Dropdown)

- Then in the Responses tab, click on the green spreadsheet icon and link it to your existing Google Sheets (or create a new sheet and copy the data to your “Expense Tracker”).

Now bookmark this form on your phone’s home screen. A quick tap, fill in the details, hit submit – and the expense will be directly logged into your sheet. My expense tracking has become very smooth and consistent after this trick.

Tips for a Sustainable Google Sheets Finance System

Setting up a system is one thing, but running it regularly is another challenge. Here are some honest tips that will make your Google Sheets personal finance journey sustainable:

Start Small, Stay Consistent

Don’t try to perfectly track every single penny from the start. Just create your core sheets and start logging your main expenses. Consistency is more powerful than perfection. Doing a little every day or weekly is absolutely the best, way better than making big changes at once.

Review Regularly

It is necessary to carve out some dedicated time. I set aside 15 minutes every Sunday evening to match accounts and see the expenses of the week. And at the end of the month, I spend an hour for the bigger picture – “Did I stay within budget? Where can I improve next month? What are my goals?” This regular review keeps me on track.

Aim for Progress, Not Perfection

Sometimes there will be overspending, sometimes you will forget to log some expenses. Again – it’s normal! Don’t blame yourself. Just continue again. The goal isn’t for you to become a flawless accountant; the goal is to build better habits and gain clarity. My own journey has had its ups and downs, but overall the progress has been huge.

Customize to Your Life

Everyone’s financial journey is different. If a category is not relevant to you, change it. If you need more details in an area, add it. The greatest beauty of a spreadsheet is that it’s fully adaptable. Make it yours.

Take Control of Your Financial Future

Yes, it might seem a bit much – but trust me, it’s worth it. Managing your finances should not be scary. Using the smart workflow of Google Sheets not only provides you with numbers, but it also gives you real empowerment. You will go from guessing to knowing exactly, and feeling stressed to feeling completely in control.

I truly believe that understanding one’s money is the cornerstone of a stress-free and fulfilling life. And this simple system? It will genuinely help you in paying off debt, saving for dream vacations, building an important emergency fund, and finally achieving financial freedom.

So then, seriously, what are you waiting for? Open Google Sheets now. Create a sheet, create a budget, log your expenses. This first step will take you towards a clearer financial future. Your bank account (and your future self!) will definitely thank you.

And yes, if it still feels a little overwhelming, search online for “Google Sheets personal finance templates” – there are quite a few free templates available that you can tweak to your own preference. And if you’ve created your own awesome setup, be sure to share your tips in the comments!

Explore my other posts below:

- Unlock Your Superpower: Master Your Smart Multi-Monitor Workflow!

- How to Start Automating Your Freelance Client Onboarding

- How to Use Your Smartphone as a Powerful Automation Hub